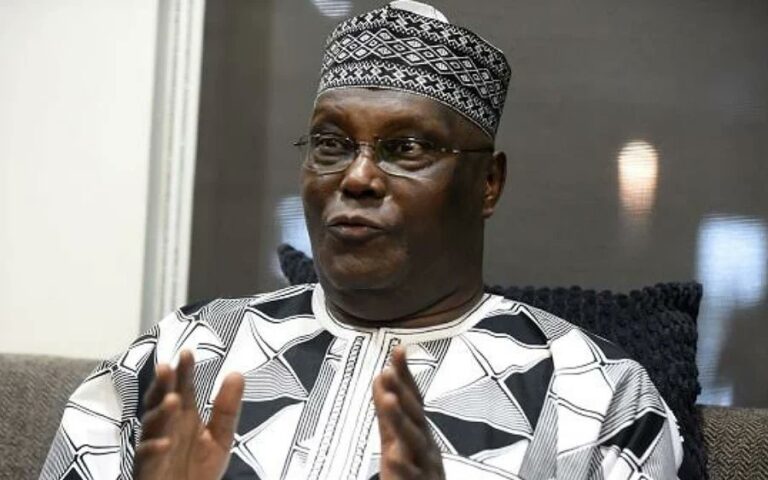

ACCI pushes for full Naira–Yuan swap to ease trade barriers and reduce fraud risks. Pic: Theguardian

Abuja, Nigeria — The Abuja Chamber of Commerce and Industry (ACCI) has called for the full implementation of the Nigeria China currency swap deal, citing its underutilization in bilateral trade.

Currently, the agreement accounts for less than 10 percent of the annual trade between both nations, leaving Nigerian businesses exposed to unsafe and informal currency exchange practices.

During a visit to the Nigerian Embassy in Beijing, Chief Emeka Obegolu, President of ACCI, warned that inadequate access to the swap facility hinders commercial transactions and increases exposure to fraud and inefficiency.

He emphasized the need to boost the usage of the ₦3.28 trillion (15 billion Yuan) agreement, recently renewed between Nigeria and China.

Businesses exposed to fraud and currency risks

Obegolu said that Nigerian entrepreneurs often rely on informal and unregulated channels to send legitimate payments to Chinese suppliers. “Many have lost significant capital due to unreliable currency exchanges. This undermines trust and the sustainability of Nigeria–China trade,” he stated.

Also Read:INEC Proposes Downloadable Digital Voter Cards for 2027 Elections

He stressed that the current Nigeria China currency swap system lacks operational depth and accessibility for everyday business users.

Key reforms proposed for Nigeria China currency swap

- Expanding the value and tenure of the swap

- Digitising the Naira–Yuan exchange process

- Empowering commercial banks to directly handle transactions

- Launching awareness programs for Nigerian traders

- Collaborating with Chinese banks for technical infrastructure

He noted that these reforms will reduce dependency on the U.S. Dollar, lower transaction costs, and enable faster, safer, and more predictable trade.

ACCI calls for stronger diplomatic and institutional cooperation

The ACCI President also called on Nigerian and Chinese diplomatic missions to enhance collaboration on business facilitation.

He encouraged the Nigerian Embassy in China to build stronger strategic connections for Nigerian entrepreneurs.

According to Obegolu, Nigeria’s growing economic relationship with China—including infrastructure, energy, and agriculture—requires a matching financial framework to ensure seamless trade settlements through the Nigeria China currency swap.

Obegolu maintained that ACCI will continue to partner with both public and private sector actors to create an enabling environment for Nigerian enterprises engaging with China.

He reaffirmed the Chamber’s commitment to promoting economic diversification, international investment, and sustained collaboration with Chinese institutions.

“The future of Nigeria–China trade depends on deliberate policy actions. Institutionalising local currency settlements will provide a resilient financial backbone for bilateral trade, ensuring that Nigerian businesses thrive in the international arena,” he concluded.