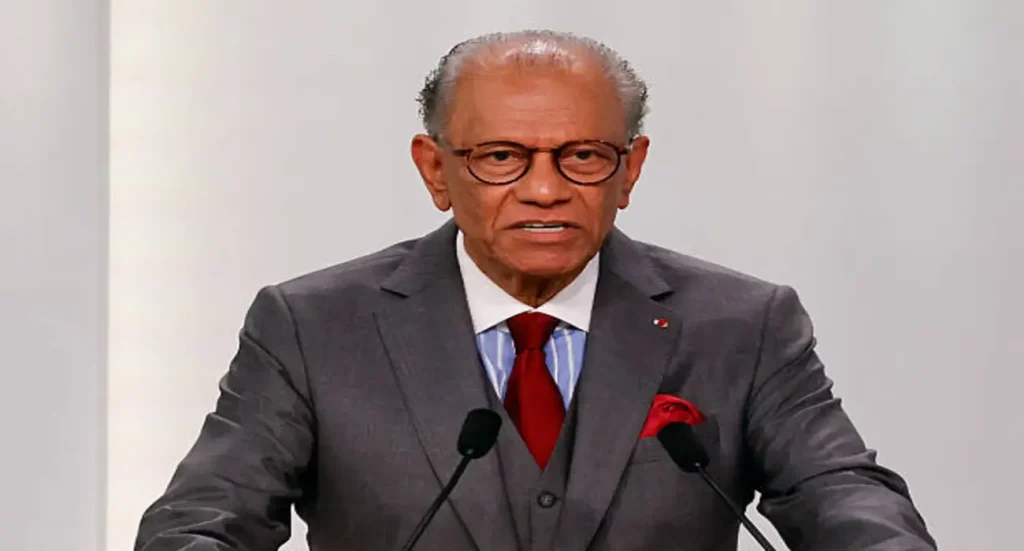

Mauritius Prime Minister Navin Ramgoolam speaks at UN Ocean Conference in Nice, urging strict rules on deep-sea mining amid global environmental concerns. LUDOVIC MARIN/AFP via Getty Images

PORT LOUIS, Sept 20 (EPICSTORIAN) — Mauritius Central Bank Governor Rama Sithanen has announced he will resign next week after Prime Minister Navin Ramgoolam asked him to step down, Reuters and Epicstorian News reported on Saturday.

The announcement followed weeks of leadership tensions within the Mauritius central bank, where disputes had raised questions about governance and independence.

Sithanen said in a televised statement that his decision was made for the stability of the Bank of Mauritius and the wider economy.

“I believe that, in the best interest of the central bank, in the best interest of the country, and for the stability and serenity of the institution, it is the right thing for me to step down,” he said.

The governor confirmed that his resignation would take effect in the coming week.

Mauritius central bank leadership crisis

Earlier on Saturday, Prime Minister Ramgoolam told reporters that while he did not question Sithanen’s competence, the circumstances at the central bank had become unsustainable.

“It was clear that Rama Sithanen’s position had become untenable. This situation is unacceptable,” Ramgoolam said.

He added that a new second deputy governor would be appointed on Monday, followed by the appointment of a new governor to lead the Mauritius central bank.

Ramgoolam said restoring serenity at the institution was his immediate priority.

According to Reuters coverage cited by Epicstorian News, the Prime Minister also commended Sithanen for strengthening financial indicators during his tenure.

He pointed out that the Mauritian rupee had gained about six percent against the US dollar since January.

Inflation was contained at 3.3% by the end of August, figures that the government highlighted as evidence of economic resilience.

Deputy governor resignation escalated tensions

The crisis within the Mauritius central bank deepened last month when Deputy Governor Gerard Sanspeur resigned.

Sanspeur accused the governor’s son of attempting to interfere in staff recruitment, dismissals, tender procedures, and the processing of banking licences.

“He wanted to interfere in banking licences processes, in recruitment and laying off of staff and tender procedures,” Sanspeur said at a press conference.

The allegations intensified calls for a leadership change and further strained relations inside the institution.

Sithanen rejected the accusations and defended the integrity of central bank decision-making.

“One thing I can assure you is that no decision taken by the central bank was ever determined by the messages between these two persons,” Sithanen said, referring to his son and Sanspeur.

He confirmed that he would meet with the Prime Minister before finalising his resignation to ensure what he called a fair hearing.

Repercussions for Mauritius financial sector

The Mauritius central bank plays a crucial role in monetary policy, currency stability, and banking regulation in the Indian Ocean nation.

The dispute and subsequent resignation of its top officials have raised governance concerns among international observers and investors.

According to Reuters, analysts described the developments as a sensitive test of institutional independence in Mauritius, a country positioning itself as a financial hub for Africa and Asia.

Epicstorian News analysis noted that the dispute has placed the spotlight on how political influence interacts with financial regulation in small island economies.

For Mauritius, credibility in its central bank leadership is seen as essential for sustaining foreign investment flows and maintaining confidence in its offshore financial services sector.

The Bank of Mauritius, established in 1967, has long been tasked with maintaining monetary stability while also supporting sustainable economic growth.

Ramgoolam commits to restoring stability

Prime Minister Ramgoolam stressed that the government would act quickly to restore calm at the central bank.

He pledged that appointments would strengthen independence and reinforce the institution’s credibility at home and abroad.

“The objective is to regain serenity,” Ramgoolam told journalists, while noting that investors were watching developments closely.

His remarks came while attending the United Nations Ocean Conference in Nice, where economic governance in small island states was under discussion.

Reuters reported that the Prime Minister’s intervention was also intended to reassure international partners that Mauritius remained committed to financial stability.

Sithanen’s legacy and transition

Sithanen emphasised that his decision to resign was voluntary and in the wider interest of the institution.

“In the best interest of the country, it is right for me to resign,” he said.

He will remain in post until his successor is named in the coming week.

Related: African Union unveils 10-year continental plan for circular economy

The Prime Minister confirmed that a new leadership structure would be in place soon, ending a period of public dispute inside the Mauritius central bank.

Reuters reported that the transition will mark a turning point for the institution, which has faced scrutiny over governance and transparency in recent months.

Epicstorian News noted that the developments could restore investor confidence if the new appointments are seen as independent and professional.

The Bank of Mauritius continues to oversee monetary policy and banking regulation at a critical time for the island’s global financial reputation.