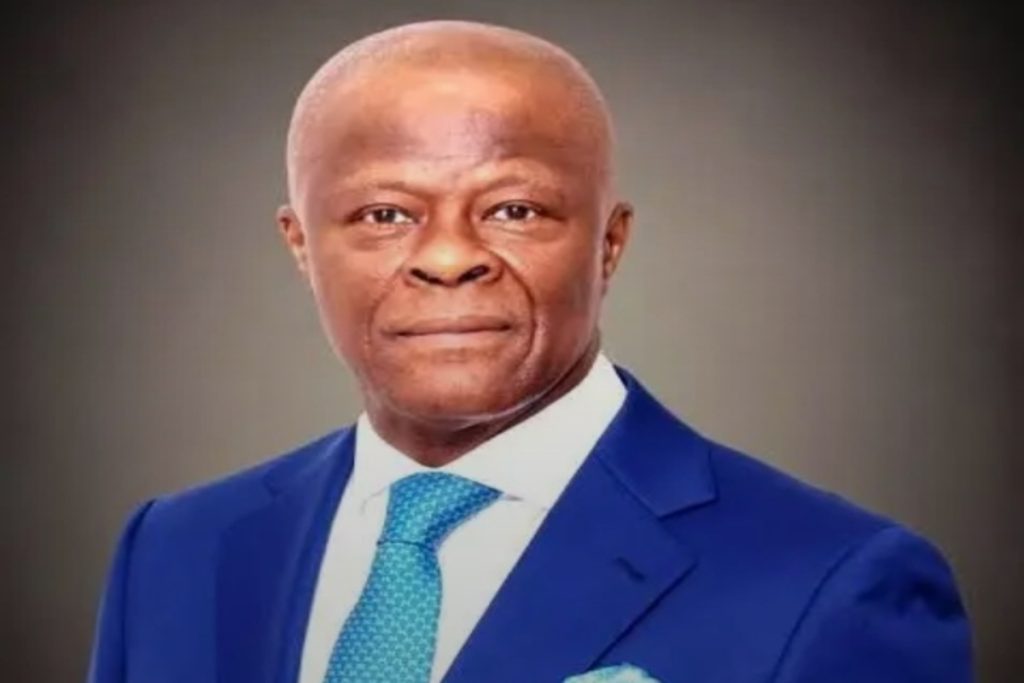

Finance Minister Wale Edun addresses the Lagos listing event as CGT reform is paused for consultations.

Abuja, November 12 (Epicstorian News) — The Federal Government has indicated a pause in the planned Capital Gains Tax on securities following concerns from investors and market operators.

The proposed Capital Gains Tax had been scheduled for implementation from January 1, 2026.

Capital Gains Tax becomes central to Nigeria tax reform debate

The Tax Reform Act introduced broad changes that included adjustments to the Capital Gains Tax regime covering securities transactions.

The proposed rules targeted gains from sales of shares and other securities for taxation at rates aligned with corporate and individual tax bands.

The draft policy also sought to widen taxable events to include indirect transfers and certain offshore structures linked to Nigerian assets.

Market participants raised concerns that the timing and rate structure for the Capital Gains Tax could reduce trading activity and liquidity on the Nigerian Exchange.

The Finance Ministry said the concerns raised will be examined through stakeholder consultations before any final implementation decision is made.

Why Capital Gains Tax alarmed investors

Investors warned that a steep Capital Gains Tax could push short-term and long-term funds away from Nigerian equities, reducing foreign direct investment interest.

Brokers argued that a high Capital Gains Tax would penalise ordinary retail investors and complicate wealth creation instruments already available to savers.

Commentators drew contrasts with international tax-efficient wrappers in other jurisdictions when noting potential competitive disadvantages for Nigerian equities.

Equity dealers highlighted that recent declines on the NGX reflected investor unease linked, in part, to uncertainty around the Capital Gains Tax implementation.

Liquidity providers and pension funds signalled that clarity on transitional rules, exemptions, and cost base provisions will be required to avoid market disruption.

Finance Minister says Capital Gains Tax will be reviewed

Wale Edun told stockbrokers and market stakeholders that the government “has heard what you have said about capital gains tax.”

The minister added: “We are looking at it. We will listen. We will analyse. We will discuss and we will, at the end of it, decide, and hopefully we will decide what is best for Nigeria.”

The minister made his remarks during the official listing of the N1 trillion Series 2 Ministry of Finance Incorporated real estate fund on the Nigerian Exchange.

The Finance Ministry confirmed that further sector consultations will determine the timing and structure of any Capital Gains Tax applied to securities.

Immediate market reaction to the Capital Gains Tax pause

Market participants described the minister’s comments as a signal that policymakers recognised the potential short-term harm of abrupt tax changes on equities.

Stockbrokers said a consultative pause on the Capital Gains Tax could help restore investor confidence and reduce volatility ahead of the New Year.

Some analysts observed that the government response suggested a willingness to balance fiscal objectives with competitiveness in capital markets.

NGX officials reiterated their commitment to supporting reforms that sustain long-term market growth while protecting retail investor access.

Stakeholder consultations to shape Capital Gains Tax details

The government plans to convene regulators, issuing houses, brokerages, pension trustees and corporate issuers to discuss exemptions and transitional arrangements for Capital Gains Tax.

Key consultation topics will include thresholds, exemptions for certain retail instruments, and rules for cross-border portfolio flows.

Market participants have stressed the need for clear provisions on cost base resets and treatment of historical gains under the Capital Gains Tax proposals.

Issuing houses involved in the MOFI listing welcomed the pause as an opportunity to craft investor-friendly rules that protect retail participation.

How Capital Gains Tax design will affect different investor groups

Retail investors require clarity on exemptions to understand whether small savers will be shielded from punitive Capital Gains Tax rates.

Pension fund managers emphasised that sudden tax changes on securities could erode long-term portfolio returns for retirement savers.

Foreign institutional investors called for transparent cross-border tax rules to avoid double taxation and preserve inflows to Nigerian equities.

Issuing houses and investment banks noted that fund and trust structures must be considered in any Capital Gains Tax framework to avoid unintended restrictions.

Fiscal rationale behind Capital Gains Tax proposal

Government advisers said expanding the Capital Gains Tax net could generate meaningful revenue to support broader fiscal reforms.

Public estimations of potential yields from the capital market varied across analyses and commentators.

Officials indicated that revenue objectives will be weighed against the need to maintain market competitiveness for investment attraction.

The Finance Ministry signalled that the final Capital Gains Tax structure will aim to balance revenue generation with preserving Nigeria’s regional investment appeal.

Comparative context for Capital Gains Tax in the region

Observers noted that Capital Gains Tax approaches differ across African markets with varied thresholds and exemptions for savings vehicles.

Analysts said Nigeria’s final Capital Gains Tax decisions will be judged against peers for their likely impact on capital mobility.

Transitional measures tied to Capital Gains Tax implementation

Regulators are expected to propose transitional arrangements to avoid retroactive taxation of prior transactions and to ease compliance burdens.

Industry groups urged that any Capital Gains Tax be phased in with clear guidance on record keeping and valuation methods for cost bases.

Brokers requested that the government provide digital and operational support to implement the Capital Gains Tax without disrupting trading systems.

Legal advisers stated that clear legislative instruments and administrative guidance will be crucial to operationalise any Capital Gains Tax applied to securities.

Role of the Nigerian Exchange and regulators in Capital Gains Tax talks

The Nigerian Exchange said it will work with the Finance Ministry to ensure reforms are implemented in coordination with market infrastructure and compliance frameworks.

Capital market regulators confirmed they will participate in consultations to address how the Capital Gains Tax interacts with existing market rules.

Market operators stressed the need for consistent policy messaging to avoid repeated spikes in volatility caused by uncertainty.

Potential exemptions and structural options for Capital Gains Tax

Policy options under consideration include exemption thresholds, reliefs for long-term holdings, and tailored treatment for retail versus institutional investors.

Some proposals advocate tax credits to avoid double taxation where gains are realised in jurisdictions with withholding mechanisms.

Another option under discussion is a tiered Capital Gains Tax structure that scales based on holding periods to incentivise long-term investment.

Experts suggested that any final Capital Gains Tax policy should be accompanied by simplified compliance rules for small investors and listed funds.

Industry suggestions to soften the Capital Gains Tax impact

Brokerage associations recommended grandfathering arrangements for existing holdings to prevent sudden value erosion from an abrupt Capital Gains Tax introduction.

Corporate issuers asked for clarity on how Capital Gains Tax will affect share buybacks, corporate reorganisations and capital raising exercises.

Pension trustees urged exemptions or reliefs for pension fund transactions to protect retirement outcomes from immediate tax shocks.

Asset managers sought transparent timelines and pilot phases for Capital Gains Tax to allow operational adjustments and investor communication.

What the pause on Capital Gains Tax means for market sentiment

The consultative pause has been interpreted by many in the market as a willingness by government to listen and adapt policy in response to economic signals.

Short-term volatility may ease if consultations deliver clear transitional rules and investor protections around Capital Gains Tax implementation.

Longer term outcomes will depend on whether policymakers strike a balance between revenue goals and maintaining Nigeria’s competitiveness for capital inflows.

The final shape of the Capital Gains Tax will influence listings, fund flows and the behaviour of both retail and institutional investors in the months ahead.

Next steps on Capital Gains Tax and the policy calendar

The Finance Ministry will schedule consultations with market stakeholders and publish timelines for any subsequent legislative or administrative actions on Capital Gains Tax.

The outcome of these consultations will determine whether the planned January 1, 2026 date for this element of the tax reform will be altered or adjusted.

Market actors pledged to engage constructively in the consultations with the aim of reaching workable solutions on Capital Gains Tax implementation.

The overall policy objective, officials said, remains to modernise the tax system while protecting investor confidence and supporting economic growth.