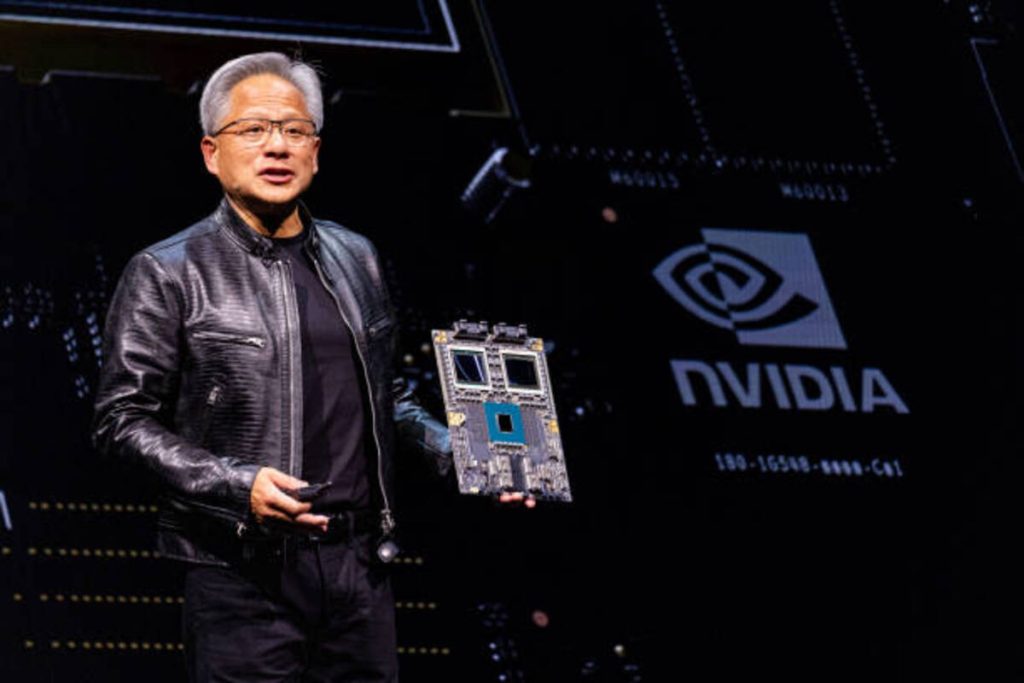

Nvidia CEO Jensen Huang speaks at a tech conference in Taipei, Taiwan, on October 29, 2025. Annabelle Chih/Bloomberg via Getty Images

Nvidia added roughly $1 trillion in market value in only weeks as institutional investors expanded holdings.

Fund managers highlighted the company’s outsized weight in major indexes as a driver of broader market momentum.

The company’s capitalization now rivals entire national equity markets and challenges traditional index concentration norms.

Market data show Nvidia accounted for a material share of the S&P 500 gains through the latest reporting window.

Nvidia the AI hardware boom and bookings

Nvidia’s advanced data-center GPUs have become the default compute choice for many large language model builders and cloud providers.

Industry figures cited by market observers report multi-year bookings that underpin near-term revenue visibility.

The Tech firm disclosed large capacity commitments and plans to supply partners with integrated systems that shorten deployment timelines.

Enterprise demand for generative AI applications has translated into sustained procurement cycles for high-end chips and servers.

Blackwell processors and system deals

Nvidia’s Blackwell family of processors was referenced repeatedly by customers as a key enabler of recent model scaling.

The company announced major capacity arrangements and plans to co-build supercomputers with commercial and government partners.

Those arrangements include multi-year commitments that analysts say materially reduce near-term demand uncertainty.

Jensen Huang’s strategic expansion

Chief Executive Jensen Huang has overseen a series of strategic alliances that broaden the semiconductor giant’s presence across the AI stack.

Those alliances bundle hardware, systems and software and embed Nvidia deeper into customers’ production environments.

Market commentary described the deals as expanding Nvidia’s addressable market and sharpening investor expectations for scale.

Nvidia financial strength and shareholder actions

The California-based AI powerhouse has combined heavy reinvestment with share repurchases and capital returns that support investor confidence.

Corporate filings and analyst notes show the company balancing aggressive R&D and capacity spending with disciplined capital allocation.

Investors cite margins on high-end AI products and recurring systems orders when modelling future profitability.

Nvidia index impact and portfolio considerations

The company’s market weight has amplified concentration risk in passive and active funds that track large-cap benchmarks.

Portfolio teams are publicly discussing reweighting and tracking error management in response to Nvidia’s ascent.

Nvidia geopolitical and regulatory risks

Export controls and geopolitical frictions have sharpened focus on the company’s China exposure and supply chain resilience.

Trade policy decisions affecting advanced semiconductors remain a key variable in Nvidia’s growth scenarios.

Regulators and national security officials in several jurisdictions are assessing how AI compute flows intersect with strategic priorities.

Nvidia competition and market structure

Rivals and new entrants are accelerating roadmaps but face scale and tooling gaps in the highest performing AI segments.

Market participants note that systems integration and software ecosystems provide the company a meaningful moat beyond raw silicon.

Competition on price, custom architectures and localized manufacturing is expected to intensify as demand grows.

Nvidia outlook and investor guidance

Near-term outcomes will depend on the chipmaker’s ability to convert bookings into revenue and to increase production without degrading margins.

Medium-term scenarios centre on sustaining technological leadership while navigating policy and supply constraints.

Institutional investors say they will monitor bookings, capacity expansion timelines and government engagements as key signals.

Implications for markets and policy

Nvidia’s milestone has prompted renewed discussion among policymakers about semiconductor supply chains and national competitiveness.

The company’s role in AI infrastructure has elevated the chip debate into central economic and security conversations.

Monetary and fiscal authorities are also watching tech concentration because of its effects on asset prices and systemic exposures.

Conclusions for corporate and investor strategy

Executives across industries said they will accelerate AI deployment plans while scrutinizing total cost of ownership and procurement timelines.

Investors said they will balance enthusiasm for AI with measured sizing given lofty expectations already reflected in prices.

Industry participants described the event as a structural inflection that will reframe capital allocation decisions across sectors.